To get started in investing in stocks, you need to know how to buy shares through a brokerage or your retirement account. Buying penny stocks can be another option. There are several ways to invest, including robo-advisors and rebalancing your portfolio. To get started, you will need to set your investment goals and assess your risk tolerance. You should rebalance your portfolio on a periodic basis to make sure it is in top shape.

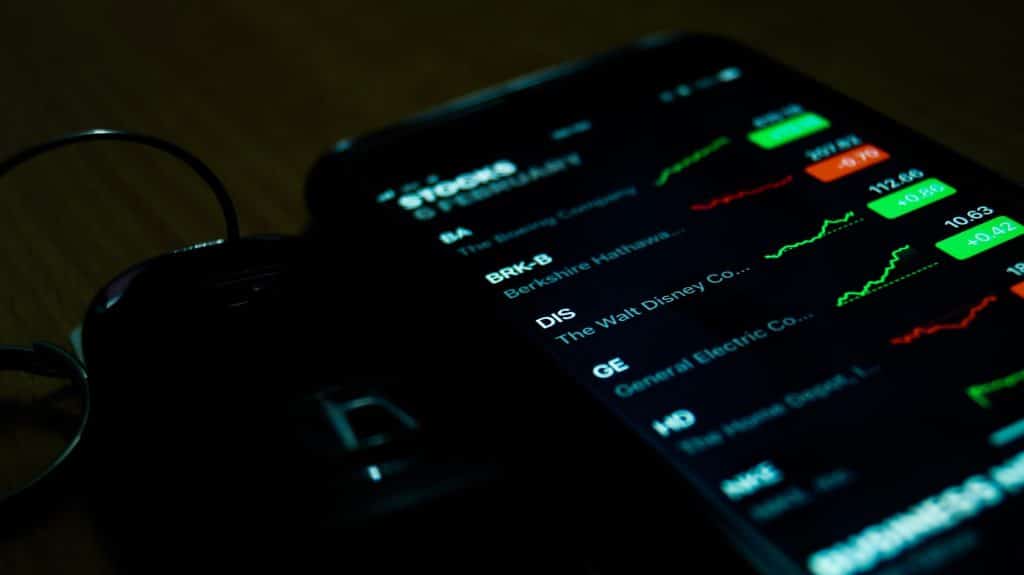

Investing in stocks

If you’ve ever wanted to learn more about stock trading, this article is for you. The first step is to open a brokerage account. You’ll be required to deposit a small amount of money in this account. Owning a stock represents ownership in a company. Common stocks allow you to vote. Most companies grant one vote per share. Some companies also pay out dividends, or payouts based on the profitability of the company.

First, you’ll need to open a brokerage account. Many companies offer these types of accounts, which can be very easy to open. You can fund your account through EFT transfers, wired funds, or a check. Make sure you are comfortable with the risk involved. Remember that stock market investments typically grow in value over time. But short-term market fluctuations can put your money at risk. You’ll need to determine your risk tolerance and how much money you can lose before investing.

Buying stocks through a brokerage

Buying stocks through a brokerage will help you make informed decisions. The best time to buy a stock is during the middle of the trading day. While it is advisable to buy in the morning or at night, this method may not be ideal for first-timers. On Monday, most stocks will experience a drop as the market digests weekend news. The good news is that stocks on Friday tend to rise, which is good for short-term traders but bad for long-term investors.

Generally, stockbrokers do not allow you to buy stocks using a credit card. However, there are some exceptions to this rule. If you want to buy stocks on a credit card, you will have to open a brokerage account and pay with a credit card. However, this method is risky as stocks can fall in value and you may end up wiping out your investment. To avoid this risk, you should use an online trading platform that accepts credit cards.

Investing through a retirement account

Investing through a retirement account has many benefits, including tax advantages. Unlike a regular savings account, you can use your retirement account to invest in a variety of different assets. In addition to stocks and bonds, you can invest in real estate, private equity, precious metals, and even cryptocurrency. You can choose how much of your money to invest in each type of investment. However, if you have the time and patience to do your research, investing through a retirement account may be the right choice for you.

Individual retirement accounts (IRAs) are a great way to save for retirement. They offer tax advantages, allowing your savings to grow faster than a traditional savings account. Many retirees are in a lower tax bracket than they were pre-retirement. Investing through a retirement account may be the perfect way to supplement an employer-sponsored retirement plan. The tax benefits of IRAs also make it possible to supplement your employer-sponsored retirement plan. By investing through a retirement account, you will be able to enjoy a higher rate of growth than your employer-sponsored plan.

Buying penny stocks

Before you start trading penny stock, you should decide your investment objectives. These goals may include the price range of the penny stocks you are interested in, and whether you want to invest in individual companies or industries. You can also choose how you plan to research, monitor, and trade the penny stocks. Also, you should determine which broker you will use to help you with your investment. Once you’ve decided your goals, it’s time to find the best penny stock to trade.

You can buy penny stocks without investing a large sum of money. The majority of penny stocks are priced between $1 and $5. You can find them at many online brokerages or in newspapers. However, you should consider the risks and requirements of trading penny stocks before you start. Make sure to do some research and find an established broker who specializes in penny stocks. You can use their experience and advice to help you find the best penny stocks at URL.

Investing through a public app

How to get started in stocks through a Public app can be overwhelming at first, but there are ways to get the information you need in a quick, convenient manner. These apps have a broader audience than your average brokerage account and allow you to follow others’ portfolios in real time. For example, you can follow someone on Twitter or Facebook who has made great investment decisions, and see why they’re happy with their choice. Public’s social feed also offers you an easy way to follow stocks that are trending in the market and participate in stock chats. Public allows you to follow people you follow, and even reinvest dividends that you receive.

Public is a free app that offers commission-free brokerage services. By breaking up large stocks into smaller units, Public makes it easy for more people to buy shares of high-priced stocks. Their fee structure is standard industry-standard, and their low trade minimum keeps every dollar invested working for you. If you want to learn more about the stock market without paying an investment bank, Public may be the best option for you.